Blog

Remodeling news, home improvement tips, new design trends, announcements and everything else home remodeling...

The Future of Remodeling With New Transparent Solar Windows

Blog

Make toast with your windows? Maybe soon you can! Industry news about new technology giving homeowners more bang for their buck with innovative technology.

Previous Posts

Another Perfect Game of Satisfied Remodeling Clients

Murphy Bros. has been awarded The "10 in a row" honor for the highest client satisfaction by GuildQuality.

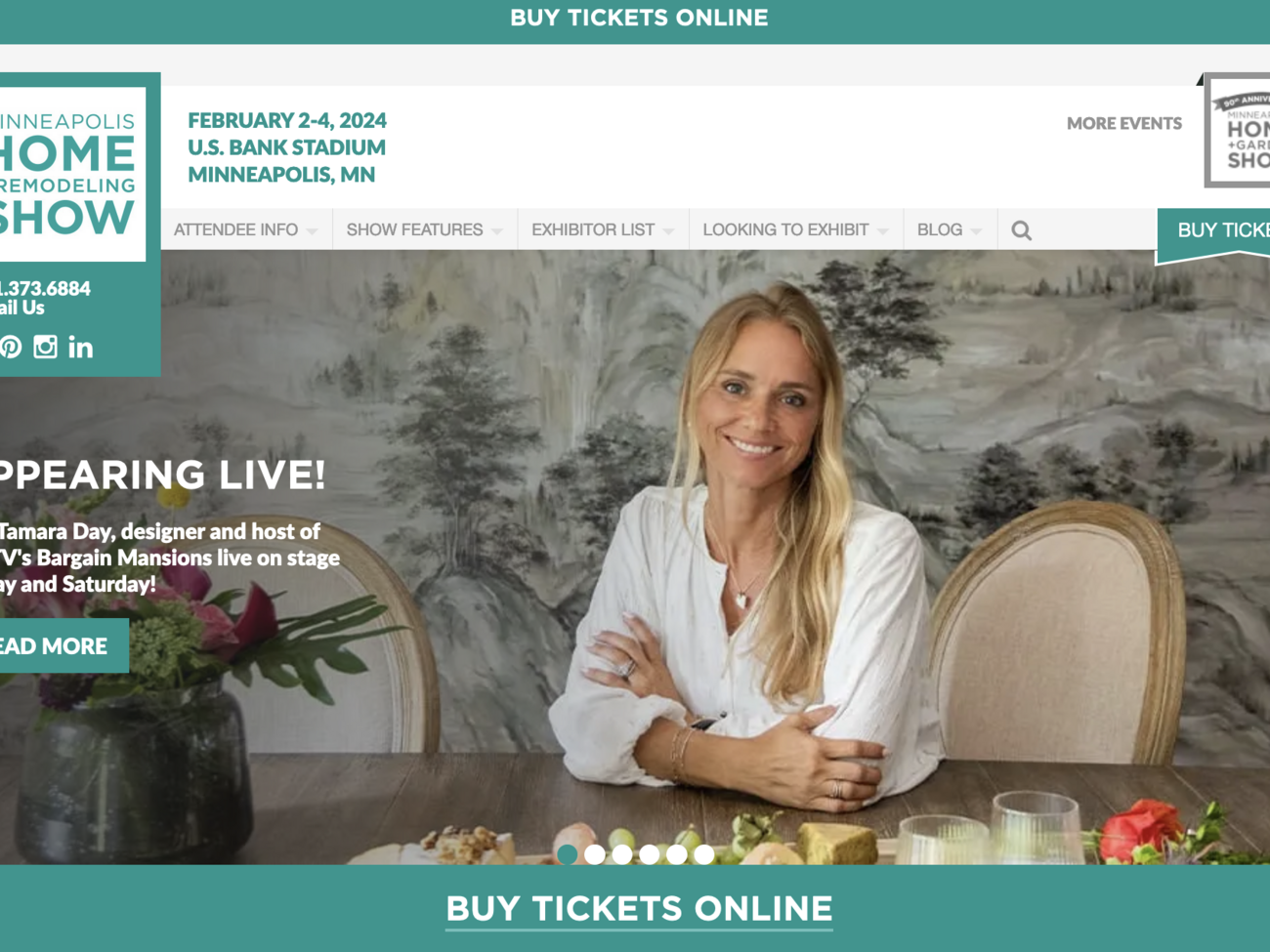

Minneapolis Home Remodeling Show 2024

The best, brightest, most intimate home remodeling show on the 50 yard line of the US Bank Stadium! Visit us at booth 643!

2024 Home & Garden Show

Don't miss the historic 90th edition of the Minneapolis Home & Garden Show at the Minneapolis Convention Center Feb. 21-25. Visit us at booth 2415!

Five 100% satisfied clients in a row—Again!

This designation from GuildQuality is about exceptional service repeated 5 times in a row.

Radiant Heat for Remodeling & Comfort Radiant Heat for the entire home!

Exciting new sustainable heating possibilities for remodeling!

Pantone Releases Spring/Summer 2024 Color Trend Report

For homeowners looking to refresh their living spaces with a splash of vibrant hues, this report is nothing short of a treasure trove.

Murphy Bros. is 209 in Qualified Remodeler TOP 500 for 2023

"Any time you improve nearly 100 ranking points in company performance in one year people take notice,” said Murphy Bros. President Ben Murphy."

Murphy Bros. Wins 3rd Client Satisfaction Award!

Murphy Bros. Honored again as Top Client Satisfaction Leader

Winner 2023 BBB Torch Award for Ethics in Business

For the second time Murphy Bros. has won the BBB Torch Award!

May is Home Remodeling Month. So what are you doing about it?

Do you have the right plan to take advantage of it?

Spring Cleaning with Old Paint

Not you Nelly. We're talking about the old paint that comes in cans, that has been littering your barn for the past 10 years.

Cost Vs. Value 2023

The Minneapolis/St. Paul CVV report is out with a couple of surprises for kitchen/bath remodels

We are a finalist for the BBB Ethics Award—Again!

Having won this Ethics in Business honor back in 2017 we are now up for it again.

Best of Houzz 2023 Awarded to Murphy Bros.

This is our latest Best of Houzz award for which we are most grateful!

2022 Cost Vs. Value Report

The annual report just came out and to no one's surprise costs & values continue to rise

Murphy Bros. recognized with 8th Guildmaster Satisfaction Award

Why measuring client satisfaction matters.

2021 Tile Style Guide

The latest trends in Minneapolis and St. Paul homes that might just surprise you!

The Ideal Home Office Is Lacking One Thing

Sure it’s remotely functional, but does it make your brain happy?

2021 Cost Vs. Value Report

A synopsis of the 2021 Cost Vs. Value Report shows changes on both ends

Is the cost of a can of paint really going up 40%?

Even though price increases are coming there's still some good news

Wet bars are back! And they have a whole new look!

The solid wood alternative to quartz or granite

Moisture control in the winter

This house is too dry. This house is too humid. This one is just right!

Penny Wise — A cautionary tale of homeowner supplied labor & materials

What works and what doesn’t in saving money during a remodel

We're Moved In!

After a year and a half of rebuilding efforts Murphy Bros. has moved into it's new facility!

Sky Rocketing Lumber Prices Affect Remodeling

Why did this happen and could it affect your remodel?

Your Home is More Than a Sanctuary. Now it is EVERYTHING.

If only your home was actually built for “everything.”

Caring for Mom & Dad in Pandemic Times

Do we bring them home to live with us or keep them safe in their facility?

An Update on Rebuilding Efforts & Remodeling During This Pandemic

This is a personal message from the owner John Murphy for May of 2020

Leaner. Stronger. Better.

Recovering from our recent office fire sheds new light on everything

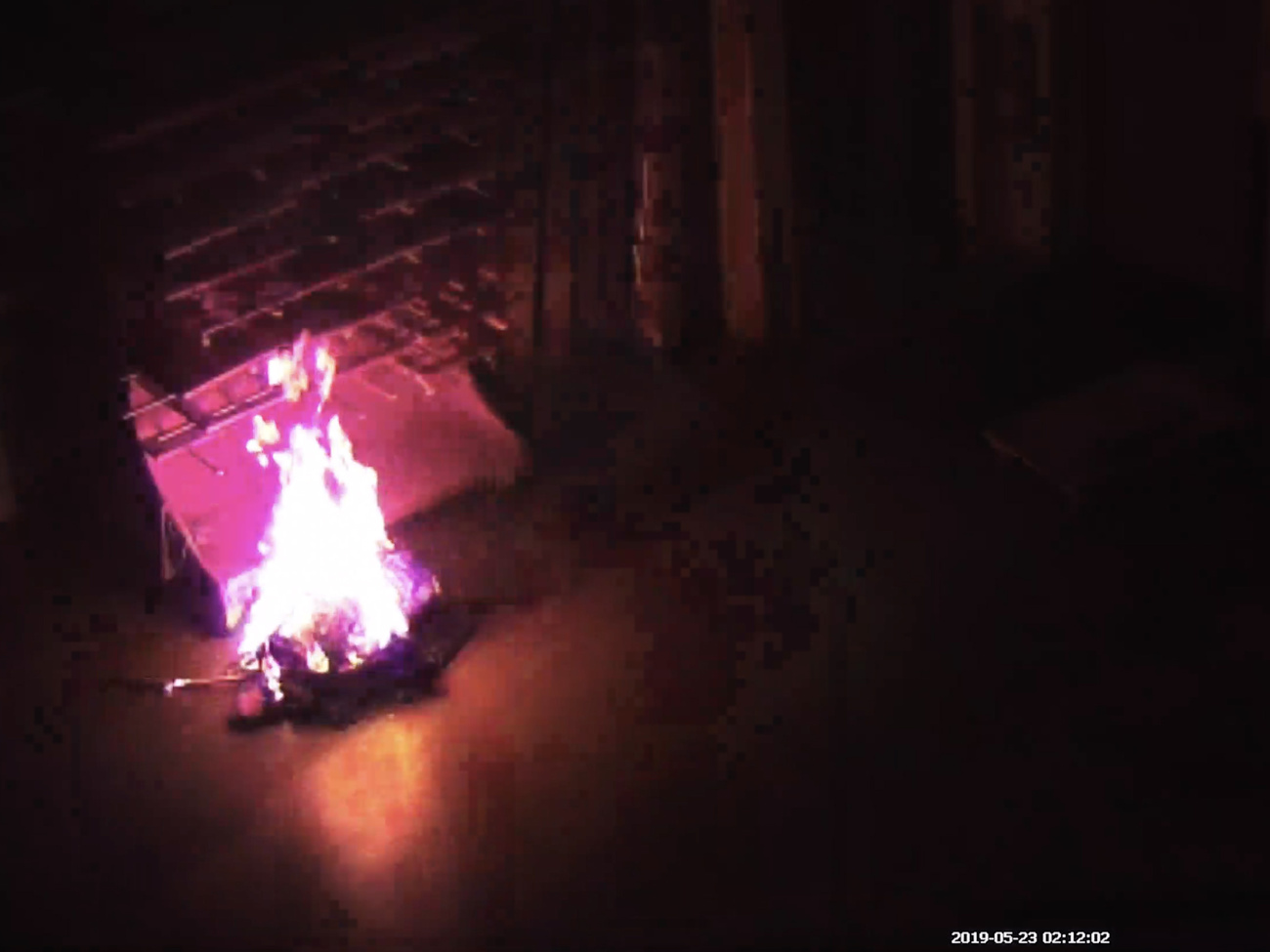

Anotomy of an Office Fire

On May 23, 2019 a rag sponaneously combusted burning down our office in Blaine.

You Can Save Money By Waiting to Remodel When...

...Fish begin riding bicycles as pigs circel overhead

Paint Paralysis is Real & You Might Have it!

Scared of Picking a Paint Color? You're Not Alone.

Homeowner Pessimism Hits 10-Year High!

What's the impact among homeowners considering a remodel?